Q1 2024 Narrative Report

The first quarter of 2024 has been marked by dynamic shifts and explosive growth in various cryptocurrency narratives. This report will outline the top performing narratives and highlight the assets that have led these trends in Q1 of 2024.

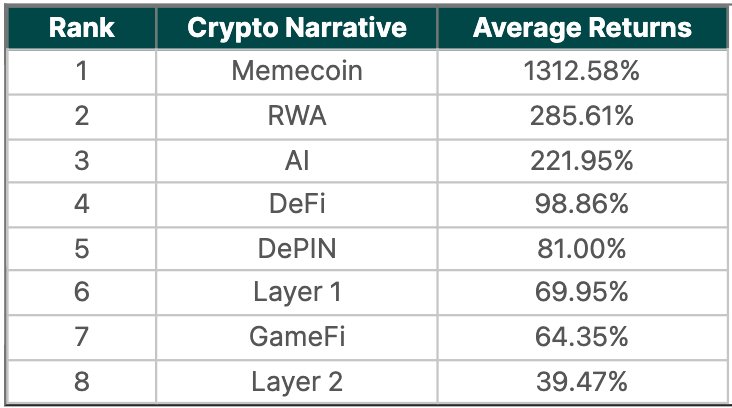

The following will outline the crypto narratives’ performance in Q1 2024, ranked by the average quarter-to-date price returns of their top 10 tokens:

Memecoins

Performance: +1313%

Top Performers:

Brett (BRETT): Achieved a staggering return of 7727.6% by the end Q1 compared to its launch price, making it the most profitable memecoin.

Dogwifhat (WIF): Gained 2721.2% following viral popularity, and was one of the main coins that led to the memecoin surge.

The memecoin narrative outperformed all other narratives, being 4.6 times more profitable than its closest competitor (RWA), and 33.3 times more than the least profitable narrative (Layer 2s) demonstrating the massive appeal and speculative drive within this sector.

Real World Assets (RWA)

Performance: +286%

Top Performers:

Ondo (ONDO): The emergence of Ondo in early January saw it rise 352% by the end of the quarter.

TokenFi (TOKEN): Gained the most at 1074.4%.

The surge in RWA narrative saw substantial growth following BlackRock initiating a new real-world asset (RWA) tokenisation fund on the Ethereum network. Larry Fink, the chairman and CEO of BlackRock, commented that ETFs are the initial steps toward tokenisation, expressing his belief that "this is where we're going to be going."

Artificial Intelligence (AI)

Performance: +222%

Top Performers:

Fetch (FET): Increased 378.3% and during this period it announced its merge with Ocean Protocol and SingularityNET

Bittensor (TAO): Experienced a 96% increase in Q1

This narrative continued to grow as integrations between AI technologies and blockchain platforms deepened, offering new utilities and enhancements.

Decentralised Finance (DeFi)

Performance: +98.9%

Top Performers:

Jupiter (JUP): The launch of Jupiter in February marked a 125.7% by end of the quarter.

Maker Dao (MKR): Makers price increased by 121.2% as lending protocols saw increased volume and TVL.

The narrative gained momentum after a proposal to switch fees on Uniswap (UNI), leading to heightened activity and interest. Jupiter also had its token launch on Solana in february sparking even more interest amongst DeFi products and how users can get respective airdrops for using these applications.

Decentralised Publishing and Information Networks (DePIN)

Performance: +81.0%

Top Performers:

Arweave (AR): Recorded impressive gains of 292.5%, leading the DePIN tokens.

Render (RNDR): Achieved 125.2% gains

Despite initial losses, DePIN ended Q1 positively. The NVIDIA chip shortages over the past years have left many AI startups scrambling for computing power, which has given rise to many DePIN protocols that incentivise users to contribute their idle computing resources to the network.

These decentralised computing platforms allow AI developers to access the processing power they need in a more cost-effective and scalable manner, without being beholden to a few centralised cloud providers. By tapping into a distributed network of individual contributors, DePIN projects can offer flexible, on-demand computing resources to meet the growing demands of the AI industry.

Layer 1 (L1) Platforms

Performance: +70.0%

Top Performers:

Toncoin (TON): Grew by 131.2%, becoming the top-performing large L1 cryptocurrency.

Solana (SOL): Saw a gain of 91.9%, returning to its 2021 price levels.

Layer 1s did extremely well last cycle as we saw the emergence of new chains such as Solana, Near, Solana's performance has been positively influenced by the ongoing memecoin trend and the numerous airdrop opportunities within its ecosystem. This ultimately increased the ecosystem's total value locked (TVL) which brought more users and developers to its chain.

GameFi Sector

Performance: +64.4%

Top Performers:

Echelon Prime (PRIME): Led the sector with a 124.0% increase, showcasing strong performance in gaming and finance integration.

Echelon Prime is making significant strides in the crypto gaming and AI industries. Its main game, Parallel, successfully raised substantial funding, and they are also developing a pioneering AI survival simulation game called Colony, set to launch by year-end. Echelon Prime is notable for being the most popular token in GameFi, which is part of a global gaming industry worth $300 billion. Despite being relatively new and lacking centralised exchange adoption, Echelon Prime is built on the thriving Base layer 2. Moreover, they recently introduced WAYFINDER, an AI tool that enables blockchain navigation and transaction management through AI agents, each equipped with their own wallet.

Layer 2 (L2)

Performance: +39.5%

Top Performers:

Stacks (STX): Notable gains of 142.5%, brings eyes to Bitcoins ecosystem potential.

Despite being the least profitable narrative, Stacks (STX), a L2 Bitcoin solution has shown significant strength. This is also off the back of the Bitcoin DeFi narrative and Stacks ability to scale and bring more developers and users to Bitcoins ecosystem. Meanwhile established Ethereum L2 solutions like Arbitrum (ARB) and Polygon (MATIC) faced underperformance, with Arbitrum returning only 5.6%, and both Polygon and Optimism (OP) showing marginal growth.

Conclusion

Q1 of 2024 demonstrated the volatile and diverse nature of the cryptocurrency market. While memecoins led with unprecedented margins they were also accompanied by heightened risk. Other narratives also showed substantial growth and development, each contributing uniquely to the broader digital asset class. Future quarters will likely see continued interest and perhaps shifts in these trends as new narratives arise and market trends change.